Claiming GST Incurred Before GST Registration

GST incurred before the business is registered for “GST” can be claimed if certain conditions are met. IRAS has produced a reference guide on this topic in assessing the claims, conditions for claiming pre-registration GST and documents to maintain to claim pre-registration GST.

The very first step of this process is to complete the “pre-registration GST Checklist for Self-Review of Eligibility of Claim”, which can be downloaded from IRAS link here , to assess eligibility to make a claim on GST incurred on business purchases made before GST registration. This checklist also includes a calculator feature to help the business compute the amount of Pre-registration GST claimable.

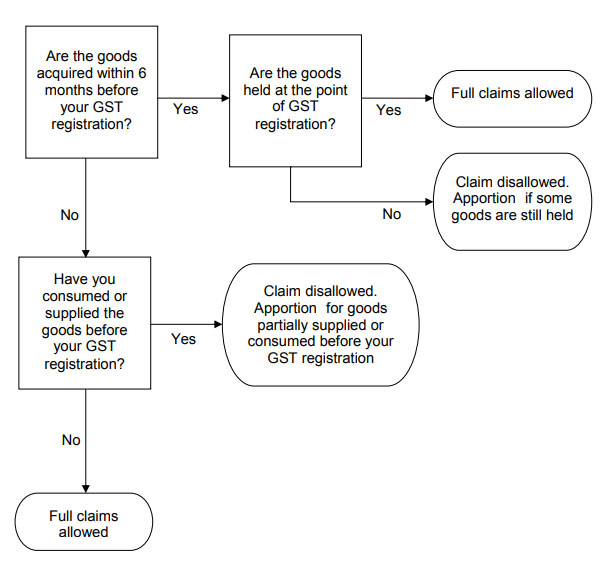

Flowchart for Pre-registration Claims on Good1

Flowchart for Pre-registration Claims on Good1

In summary, the business must satisfy all of the following conditions for claiming Pre-registration GST incurred on Goods.

- The goods are purchased or imported by the business for the purpose of making taxable supplies (standard-rated supplies and zero-rated supplies);

- For goods acquired within 6 months before the date of GST registration, the goods are still held by the business at GST registration;

- For goods acquired more than 6 months before the date of GST registration, the goods have not been consumed (i.e. used) or supplied by the business before the date of GST registration; and

- The pre-registration GST claims are not disallowed under Regulation 26 and 27 of the GST (General) Regulations.

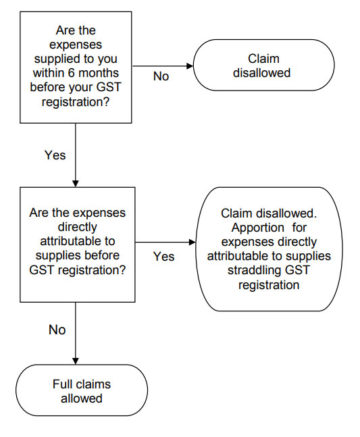

Flowchart for Pre-registration Claims on Property Rental, Utilities and Services1

The business must satisfy all of the following conditions for claiming Pre-registration GST incurred on Property Rental, Utilities and Services.

- The expenses are incurred by the business for the purpose of making taxable supplies (standard-rated supplies and zero-rated supplies);

- The expenses are incurred by the business within 6 months before the date of GST registration;

- The expenses are not directly attributable to supplies made by the business before the date of GST registration; and

- The pre-registration GST claims are not disallowed under Regulations 26 and 27 of the GST (General) Regulations.

Apportionment of Pre-Registration GST

Pre-registration GST is allowable only to the extent that the goods or services acquired are used or to be used for taxable supplies made after GST registration.

If some of the goods acquired within 6 months before GST registration date have been sold, transferred or disposed of, it is required to apportion the GST incurred according to the actual units held at GST registration date.

If the goods acquired by the business more than 6 months before GST registration date have been used to make supplies straddling GST registration (i.e. supplies before and after GST registration) or have been partially consumed before GST registration, it is required to apportion the GST incurred.

Similarly, if the services, property rental or utilities acquired by the business are used to make supplies straddling GST registration, it is required to apportion the GST incurred. Only the portion of GST that is attributable to the supplies made after registration is claimable.

Documents to Maintain to Claim Pre-registration GST

To claim Pre-registration GST incurred on goods, it is required to maintain a stock account showing:

- quantities purchased;

- quantities used in the making of other goods;

- date of purchase; and

- date and manner of subsequent disposal of both the quantities purchased and quantities used in the making of other goods

For services, it is required to maintain a list showing:

- description of services purchased;

- date of purchase; and

- date of disposal of the service (if any)

In addition, it is required to support the claims with evidence such as tax invoices, import permits, payment evidence, etc.

When and how to Claim Pre-registration GST

Pre-registration GST should be claimed in the first GST return provided that all the conditions for claiming pre-registration GST are satisfied.

The value of taxable purchases and corresponding GST amount should be included in Box 5 and Box 7 respectively.

1. Inland Revenue Authority of Singapore (2018). IRAS e-Tax Guide GST: Pre-registration Claims on Goods and Services (For Businesses Registered for GST on or after 1 July 2015) (Third Edition).

Disclaimer: This guide is intended as a general guide only, and the application of its contents to specific situations will depend on the particular circumstances involved. Accordingly, readers should seek appropriate professional advice regarding any particular tax issue that they encounter, and this guide should not be relied on as a substitute for this advice. While all reasonable attempts have been made to ensure that the information contained in this guide is accurate, Enston accepts no responsibility for any errors or omissions it may contain, whether caused by negligence or otherwise, or for any losses, however caused, sustained by any person that relies on it.